Finance operation is a pivotal aspect of leading a financially secure and fulfilling life. Whether you are just starting your career or nearing withdrawal, understanding how to effectively manage your plutocrat is essential for achieving your fiscal pretensions and securing your future.

: Preface:

In the moment’s fast- paced world, where fiscal opinions populate, learning the art of finance operation is more critical than ever. From budgeting and saving for the investing and planning for withdrawal, having a solid grasp of these fundamentals can empower you to make informed choices and make a secure fiscal future.

: Setting Financial pretensions:

The first step in effective particular finance operation is to establish clear fiscal pretensions. These pretensions can vary extensively depending on your life stage and bourns, whether it’s buying a home, saving for your children’s education, or retiring comfortably. By relating both short- term and long- term objects, you can produce a roadmap to guide your fiscal opinions.

: Creating a Budget:

A budget serves as the foundation of your fiscal plan, helping you track your income and charges and allocate coffers effectively. Start by listing all source of income and also classify your charges into fixed (similar to rent or mortgage payments) and variable (similar to groceries or entertainment). enforcing budgeting strategies like the50/30/20 rule, where 50 of income goes to requirements, 30 to wants, and 20 to savings, can help you achieve fiscal balance.

: Understanding Financial Planning:

Fiscal planning involves assessing your current fiscal situation, setting pretensions, and developing strategies to achieve them. This includes erecting an exigency fund to cover unanticipated charges and saving for withdrawal through vehicles like employer- patronized withdrawal accounts (e.g., 401 (k)) or individual withdrawal accounts (IRAs).

: Effective plutocrat operation:

Managing your plutocrat effectively involves tracking your charges, relating areas where you can reduce spending, and adding your savings rate. use tools like budgeting apps or spreadsheets to cover your cash inflow and identify patterns in your spending habits. By making conscious choices and prioritizing your fiscal pretensions, you can take control of your fiscal future.

: Saving and Investing:

Saving plutocrats is pivotal for erecting fiscal security and achieving long- term pretensions. Set away a portion of your income each month for savings, starting with an exigency fund to cover unanticipated charges. Once you have solid savings foundation, you can consider investing in means like stocks, bonds, or real estate to grow and maximize your wealth over time.

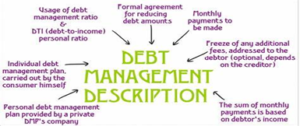

: Debt Management:

Debt can be a significant handicap to fiscal freedom, so it’s essential to develop strategies for paying off debt and avoiding inordinate borrowing. Start by prioritizing high- interest debt and making redundant payments whenever possible. Avoid falling into common debt traps like payday loans or high- interest credit cards and strive to live within your means.

: Guarding Your Finances:

Guarding your finances involves mitigating pitfalls through insurance and estate planning. ensure you have acceptable content for health, home, bus, and life insurance guard against unanticipated events. also, creating a will and establishing powers of attorney can give peace of mind and ensure your wishes are carried out in the event of incapacitation or death.

: Tutoring fiscal knowledge:

Incipiently, fostering fiscal knowledge is essential for empowering yourself and unborn generations to make sound fiscal opinions. Take the time to educate yourself about particular finance principles and partake your knowledge with family members, especially children and youthful grown-ups, to equip them with the chops they need to navigate the complications of the fiscal world.

: Conclusion:

In conclusion, learning particular finance operation is crucial to achieving fiscal stability and reaching your life pretensions. By setting clear fiscal pretensions, creating a budget, understanding fiscal planning principles, and rehearsing effective plutocrat operation ways, you can take control of your fiscal future and make a prosperous life.

—

FAQs

1. How do I produce a budget if my income varies from month to month?

– Consider using a normal of your income over the once many months as a birth and acclimate your budget as demanded. Focus on controlling your charges and erecting an exigency fund to smooth out oscillations in income.

2. What are the stylish investment options for newcomers?

– For newcomers, consider starting with low- cost indicator finances or exchange- traded finances (ETFs) that offer diversified exposure to the stock request. Robo- counsels can also give automated investment operation acclimatized to your threat forbearance and fiscal pretensions.

3. How important should I save for withdrawal?

– The quantum you should save for withdrawal depends on colorful factors, including your age, income, life preferences, and withdrawal pretensions. As a general guideline, aim to save at least 10- 15 of your income for withdrawal starting in your 20s or 30s and increase your savings rate as you approach withdrawal age.

4. Is it possible to invest while paying off debt?

– Yes, it’s possible to invest while paying off debt, but it’s essential to prioritize high-interest debt first to minimize interest costs. Consider a balanced approach where you allocate a part of your income to debt repayment and investing simultaneously, striking a balance between debt reduction and wealth accumulation.

5. Which steps can I take to improve my credit score?

– To improve your credit scores, focus on paying bills on time, keeping the credit card balances low, and avoiding to opening too many new accounts. Monitor your credit card reports regularly for errors or fraudulent activity and address any issues promptly to maintain a healthy credit profile.